This post may contain affiliate links.

The padel market is becoming bigger and bigger and you might have noticed it, depending on where in the world you are reading this. In order to make this ‘bigger’ more tangible, I will go over the size of the padel industry as well as the major contributors.

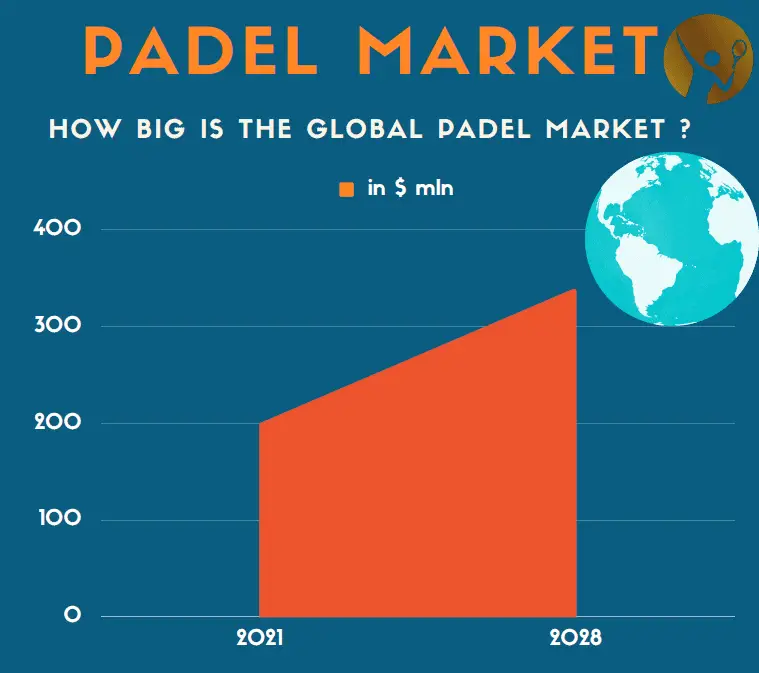

The padel market is valued globally at $198.5 million in 2021 and is expected to grow to $337.2 million by 2028. More than 60% of the global market is owned by the five biggest racket sports manufacturers, while Europe is the biggest continental market.

These numbers might give a very high-level feel for the size of the industry, but that is definitely not all you need to know about this booming market! In the remainder of this article, I discuss the underlying trends that support this growing market.

Size of Padel Industry

The size of the padel market is denominated in the amount of revenue generated by all businesses that (partially) operate in the industry. However, I am of the opinion that this number does not say much without looking at the factors that contribute to this figure.

According to Globe Newswire , the global padel market was valued at $198.5 million in 2021 and is expected to grow to $337.2 million by 2028. Globally the top 5 manufacturers in the padel market contain more than 60% of the total market share. These 5 giants are not only big players in the padel market, but they are actually big businesses that operate for the wider sports market. Companies such as Head, Dunlop, and Babolat not only manufacture all sorts of padel gear, they are major players in the racket sports market as a whole. These companies invest heavily in the growth of padel by expanding their product lines, such as rackets, balls, bags, shoes, clothing, and accessories.

, the global padel market was valued at $198.5 million in 2021 and is expected to grow to $337.2 million by 2028. Globally the top 5 manufacturers in the padel market contain more than 60% of the total market share. These 5 giants are not only big players in the padel market, but they are actually big businesses that operate for the wider sports market. Companies such as Head, Dunlop, and Babolat not only manufacture all sorts of padel gear, they are major players in the racket sports market as a whole. These companies invest heavily in the growth of padel by expanding their product lines, such as rackets, balls, bags, shoes, clothing, and accessories.

If we zoom in a bit deeper and turn our focus toward the different continents, Europe contains nearly half of the market share. This seems logical if you know about the increase in popularity of padel in Europe. Latin America is second, mainly due to the contribution of Argentina. Sales have doubled in the Argentina padel market after the pandemic (2019-2021). Third on the list is North America, where padel is mainly gaining traction in the US.

Number of rackets sold

Although we’ve covered the overall market size of the padel market, it is worth going over the number of rackets sold. Over 90% of all padel products sold are actually the padel rackets, or palas de pádel as they are called in Spanish.

The number of sold padel rackets has globally increased massively from 83,434 in 2002 to 409,158 in 2017. This means that the number almost quintupled in 15 years. That is a 5x result! During the last few years, new brands appeared and existing brands expanded their product line. Nevertheless, the five biggest players are capturing the main portion of the global market size. These companies seem to use their global popularity to make padel more accessible to the wider public. Popular padel brands differentiate themselves by focusing on the typical padel and tennis players.

has globally increased massively from 83,434 in 2002 to 409,158 in 2017. This means that the number almost quintupled in 15 years. That is a 5x result! During the last few years, new brands appeared and existing brands expanded their product line. Nevertheless, the five biggest players are capturing the main portion of the global market size. These companies seem to use their global popularity to make padel more accessible to the wider public. Popular padel brands differentiate themselves by focusing on the typical padel and tennis players.

The situation is somewhat different in the European padel racket market according to Playtomic . Big global brands such as Babolat, Adidas, Wilson, and Head are picked by 36% of the players. Let’s compare this to popular padel brands that are less renowned outside of the padel market. Brands such as Bullpadel, NOX, Starvie, and Dropshot, 27% of players chose these racket brands. This means of course that the remaining players picked up one of the other brands. These brands still make up 37% of the total.

. Big global brands such as Babolat, Adidas, Wilson, and Head are picked by 36% of the players. Let’s compare this to popular padel brands that are less renowned outside of the padel market. Brands such as Bullpadel, NOX, Starvie, and Dropshot, 27% of players chose these racket brands. This means of course that the remaining players picked up one of the other brands. These brands still make up 37% of the total.

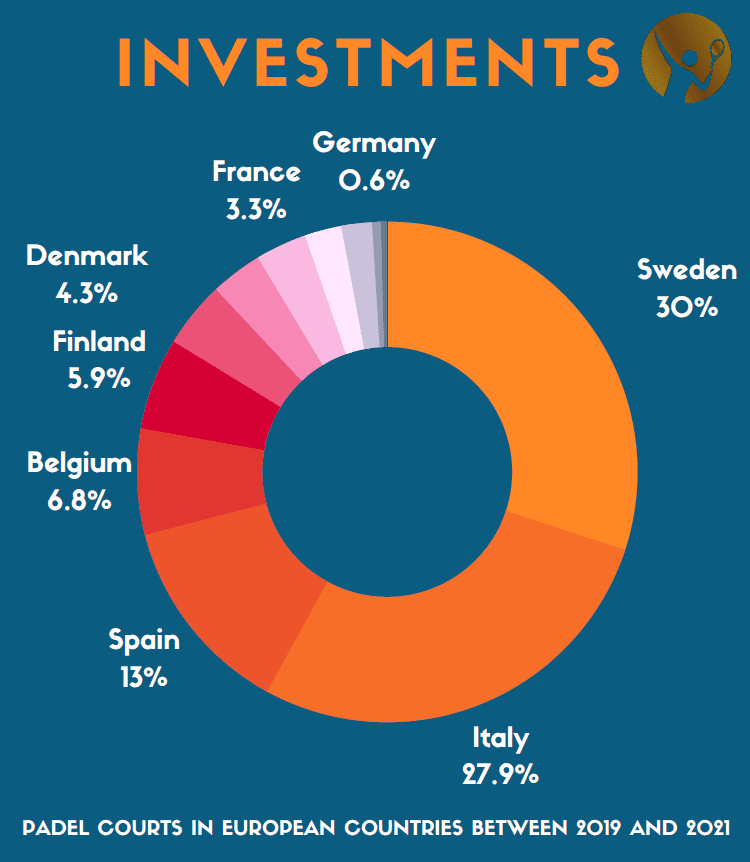

Investments in Padel Courts

Another way to measure the size of the padel market would be the investments to build padel courts in recent years. Investments of $273 mln are made between 2019-2021 in the European countries where padel is the most popular. The largest investments were made in Sweden and Italy, where respectively $81 mln and $76 mln were invested during this period. The investment in Sweden resulted in 2,783 additional courts, a 388% increase that resulted in 3,500 courts. At the same time, the number of padel courts increased in Italy by 374% to a total of 3,513 at the end of 2021.

These massive numbers in terms of investments in dollars as well as the number of new courts support the growing demand for padel courts. Despite the increased supply (padel courts), it is unable to keep up with the demand. In their global padel report, Playtomic reported that people in Belgium book a court 8.5 days in advance! To make a fair comparison, in Italy the reservation is made 6.1 days in advance and 4.7 days in Sweden.

reported that people in Belgium book a court 8.5 days in advance! To make a fair comparison, in Italy the reservation is made 6.1 days in advance and 4.7 days in Sweden.

If you are wondering about the price tag for this future growth, well around $1 billion!

As a result, the investment in additional padel courts is expected to grow even more. Between 2016 and 2021 the number of padel courts in Europe grew annually on average by 21%. However, in 2021 most courts were constructed. Playtomic predicts that the number of courts will experience annual growth of 26% between 2021 and 2025. According to this prediction, there will be around 67,000 padel courts in Europe! If you are wondering about the price tag for this future growth, well around $1 billion!

predicts that the number of courts will experience annual growth of 26% between 2021 and 2025. According to this prediction, there will be around 67,000 padel courts in Europe! If you are wondering about the price tag for this future growth, well around $1 billion!

Want to find out how many padel courts there are in the world? Just click the button and I will tell you all about it.

Sponsors and partnerships

The type of growth that is expected usually is funded through new investments as a result of partnerships and sponsors. World Padel Tour has partnerships with big companies that recognized the potential for padel early on. Big partners outside the padel industry include the Spanish beer brand Estrella Damm, the car brand Cupra and the energy company Enel. The big partners within the padel industry include both equipment manufacturers (such as Head, Bullpadel, and NOX) and court manufacturers (such as PadelGalis and Padel Nuestro).

Celebrities are also playing an important role in the growth of the padel market. Football players like Zinedine Zidane and Zlatan Ibrahimovic have opened their own padel clubs. Tennis player Andy Murray is involved in a company that is investing in a network of padel centers in the UK.

Therefore, partnerships and sponsors remain an important driver for growth in the padel market.

Check out my recent articles on Padel

Recent Posts

Padel is booming in many countries around the world, but can it actually be played in all types of weather? That is why I decided to find out the impact of the weather conditions on the court and the...

In order to not present you with the secrets alone, but provide you with some context I have weaved in these secrets when discussing the following topics: How do you take care of your padel...